Friday, October 7, 2011

Steve Jobs

Wednesday, September 7, 2011

The Failures of Abraham Lincoln

Building a Small Business That Warren Buffett Would Love - Available Everywhere, Spring 2012

Origins: The unsourced "Abraham Lincoln Didn't Quit" list reproduced above is a ubiquitous piece of American historical glurge that has been printed in countless magazines

Friday, August 19, 2011

Coke - The Secret Formula for the Original Coke

Friday, May 13, 2011

Warren Buffett On Debt

Good Debt Versus Bad Debt

Another reason why excessive debt can lead to bad results is the confusion between good debt and bad debt. As a rule of thumb, good debt is used to buy assets that generally appreciate in value and bad debt is used to purchase wasting assets that potentially require maintenance and upkeep: jet skis, plasma tvs. More specifically, Robert Kiyosaki, author of Rich Dad, Poor Dad states that good debt is used to purchase assets that put money in your pocket; rental property, dividend paying stocks, franchise businesses, and that bad debt is used to purchase toys or “doodads” that take money out of your pocket each month; jet skis, plasma tvs, cars, etc..

He goes so far as to say that a mortgage on your personal residence is bad debt since, alt

hough the house is appreciating in value, the house is taking money out of your pocket on a monthly basis through upkeep and maintenance, taxes and insurance.

In my opinion, this is a very conservative definition of bad debt. A mortgage on a house is relatively neutral and neither good debt nor bad debt. Although a personal residence creates monthly expenses, a) the house value is appreciating making it a wash on the monthly expenses and b) it is not financially prudent to rent over a lifetime.

An individual who rents for 50 years from the age of 25, paying an average monthly rent of $700 will end up paying $420,000 over a lifetime. If the rents increase at 4% a year, the renter will end up paying well over one million dollars in rent, $1,282,409 to be exact.

I don’t know about you but I can find “bearable” accommodations for half a million dollars.

Bad Debt Examples

- Automobiles

- Credit Cards

- School Loans

Good Debt Examples

- Rental Property

- Business

Neutral Debt

- Home Mortgage

_________________________________________________________________

For more information, check out my first book, My Happy Assets athttp://www.myhappyassets.com/ and the complete second book, Small Business Coffee Hour, Three Essential Ingredients for a

SuccessfulBusinessathttp://www.smallbizcoffee.com/. Both are also available at lulu.com. Happy Reading!

Also be on the lookout for my fourth book due out in February 2012 by Wiley. To stay tuned in go tohttp://www.facebook.com/myhappyasset and "like" away.

Tuesday, April 26, 2011

Warren Buffett Wants to Buy Your Small Business

Monday, April 25, 2011

Warren Buffett Wants to Buy Your Small Business

Saturday, April 23, 2011

Thursday, April 21, 2011

Dear Mr. Buffett ... Please Buy My Business!

The core of a strong business is not a mystery nor is it a complicated mess. It is found in the wisdom of Warren Buffett.

This is what he would say if he was buying your small business:

- I want a consumer monopoly …

- with a strong track record of earnings, …

- and a healthy return on equity, …

- with the ability to reinvest those earnings at a high rate of return, …

- with little debt on the balance sheet, …

- the ability to increase prices to inflation, …

- and healthy margins relative to other industries.

These are the same principles he used to turn an initial $105,000 investment into a $40 billion fortune and in a nutshell folks, these are the fundamentals that can be wired into a small business in order to produce superior results. It is not necessary to build the next global, multi-billion dollar, sugar water conglomerate in order to be successful, but the more you “Coke-ify” your business, the better the results.

_________________________________________________________________________

Friday, March 11, 2011

Three Levels of Financial Independence

And Then There’s The Riches … Now You Have It, Now What?

Really, there are three, technical levels of financial well-being along the spectrum to financial independence. Each one builds upon the other.

1. Defense and Security

First and foremost, moving closer to financial independence provides you with monetary security. If your boss comes in tomorrow and fires you, can you still afford to pay for the basic necessities; food, clothing and shelter? How long can you last before running out of money? In this book, my prescription will bring you to this stage first. Food, clothing and shelter will be taken care of. I define this stage as the ability to cover your monthly expenses via passive or portfolio cash flow. If for example, you have $3,000 a month in expenses and $3,000 in passive cash flow, then you have reached stage one. At the very least, if career or financial disaster strikes, you will be able to cover the necessities. Then and only then will you progress to stage two.

2. Having a Chair When the Music Stops

Back to my previous example, if your boss cans your ass tomorrow, it will be absolutely critical to be able to procure food, clothing and shelter. Once the essentials are covered though, you can travel further along the financial independence paradigm and build a nice chair to sit in once the music stops, or in other words, when the job ends. By nice chair I mean a source of income that provides you with excess income to buy luxuries over and above the essentials and in part, allows you indulge in a passion that you truly enjoy instead of a job unless of course you truly enjoy your job. I would define this stage as having twice the amount of monthly expenses flowing into your income column from passive and portfolio investments. If you have $3,000 a month in expenses then once you have $6,000 a month in passive cash flow, you have reached stage two.

Now, some people in the world actually enjoy the job they have right now and even if they reached this stage, they would continue to do what they do simply because they enjoy doing it and would become bored if they stopped. That is fine. Continue to work your job if you enjoy it. The point is to have options, financial independence and work that you are passionate about. Stage two is all about building a nice place to sit once the music stops and making sure you enjoy sitting there.

3. Attaining Control, Ultimate Freedom and Riches

Stage three is the ultimate goal of the financial independence paradigm. Now that the necessities are taken care of and you have a good chair to sit in after the music stops, you should now work to increase your wealth even more, give more away, spend more time with family (unless you are completely annoyed by them at this point), spend more time in service and charitable contributions, spend more time at movie theaters and ballgames, indulge in dormant hobbies such as music and art, go back to school, buy a bunch of toys and again, give more time and money away. I would define this point as generating at the least $10,000 a month in passive income and really, there is a stage four of $100,000 a month. Of course, this prescription is relative to your monthly expenses i.e., if you have $10,000 a month in expenses then truly $10,000 will be stage two for you. It can take years to get here but you hold in your hand the map to do it.

_____________________________________________________________________________

The above excerpt is from my upcoming third book My Happy Assets - Taking the Last

Steps to Financial Independence.

Businessathttp://www.smallbizcoffee.com/, only $3.99. Or both are available at lulu.com. Happy Reading!

Thursday, March 10, 2011

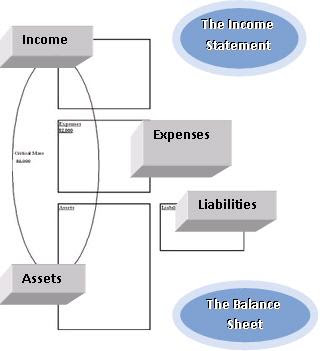

You Can Choose Your Own Financial Picture

The Spending Pattern of the Poor

“Not to call people names by labeling them as ‘poor,’ but some people literally live paycheck to paycheck. This the spending pattern of the poor. The income comes in the door and before anything can be done with it, purchase assets or obtain liabilities, the money heads right back out the door through expenses. Examples of expenses in this category may be food, clothing, rent, toys, etcetera. Each of these spending patterns is a cycle each respective class is stuck in. Poor folks are stuck in a paycheck to paycheck spending pattern with a full expense column.

The Spending Pattern of the Middle Class

This is where most folks, the majority middle class, can be found. They buy tons of crap on credit. Jet skis, houses, electronics, cars, furniture, clothes, washer, dryers you name it. The liability column feeds the expense column. Income comes thru the door, runs smack into the expense column, bloated with liability payments, and then heads right back out the door. The liability column is stacked with toys purchased to keep up with appearances for the Joneses. The middle classes’ ability to reach financial independence is greatly diminished because 1) they focus on liabilities and 2) their income to buy assets is committed to payments for toys. This is the vicious spending cycle of the middle class. Earn, buy liabilities, spend, earn a bigger income, buy more liabilities, spend. It’s not to say that you shouldn’t have toys. You should buy all the toys you want. It’s just that you should focus on assets first. Buy cash flowing assets first and then you can have toys, freedom, control and the ability to give more.

The Spending Pattern of the Rich or, The Picture of Your Final Destination

Again, rich doesn’t mean merely having gobs of money to roll around in. Money itself is not the end, it is a means to greater enjoyment of time, choice, freedom, charitable giving, time with family, toys and hobbies. Here is the spending pattern of the rich.

The rich, rich in more ways than one, focus on assets, in particular, cash flowing assets. Instead of buying plasma TVs, they buy dividend paying stocks. Instead of buying sports cars they buy four-plexes first and use the income to buy the sports car. Instead of buying a large house, they invest in covered call option stocks which deliver a monthly cash flow stream and later buy the large house. They invest in their education on the various assets before purchasing. Rich folks invest for cash flow first and capital gains second. A rich investor will buy an apartment complex first because it makes cash flowing business sense. If the property appreciates in value, the appreciation is gravy.

_____________________________________________________________________________________

The above excerpt is from my upcoming third book My Happy Assets - Taking the Last

Steps to Financial Independence.

Businessathttp://www.smallbizcoffee.com/, only $3.99. Or both are available at lulu.com. Happy Reading!

Wednesday, March 2, 2011

The Four Stages of Financial Independence

Stage 1: Monthly Passive Income = Monthly Expenses

Stage 2: Monthly Passive Income = 2X Monthly Expenses

Stage 3: Monthly Passive Income = 3.33X Monthly Expenses

Stage 4: $100,000 in Monthly Passive Income

Again, using the example of an individual with $3,000 a month in expenses, the following chart shows the monthly cash flow necessary to attain the various stages.

| | Monthly Expenses | Monthly Cash Flow |

| Stage 1 | $ 3,000 | $ 3,000 |

| Stage 2 | $ 3,000 | $ 6,000 |

| Stage 3 | $ 3,000 | $ 10,000 |

| Stage 4 | $ 3,000 | $ 100,000 |

Friday, February 18, 2011

The New Five Legged Stool of Retirement

Rental

Rental is truly the traditional home of passive cash flow through assets. Robert Kiyosaki highly recommends this asset class in order to become financially independent. In order to excel at this asset class you must become proficient at developing pro forma profit and loss statements and calculating your rate of return.

The advantages of rental over stock investments include the following:

· Property is a physical asset

· You can depreciate the building for tax breaks

· You can leverage the investment

· Control – you can raise rents, evict tenants and make property improvements

· You can insure the property against catastrophic loss

If you are not going to employ property management then be prepared to deal with clogged toilets, tenant evictions and general repairs.

Traditionally, rental is seen as one of the only games to generate significant cash flow unless you are familiar with …

Covered Calls

If you want to get away from tenant complaints, evictions and clogged toilets and you like the world of stocks, then covered calls may be cash flow solution for you. In this technique you are literally renting out your stocks on a monthly basis for cash flow. You buy a stock (at least one hundred shares) and sell someone the right but not the obligation to purchase your stock at a set price otherwise known as the strike price. The money you receive is the premium and it is yours to keep. This is your rental check and you can transfer and spend it right away or you can reinvest it.

At the end of the month, your stock is either called out or you write another call against it. If you cannot profitably write another call against it then you can follow management techniques detailed by Hooper and Zalewski in Covered Calls and Leaps, A Wealth Option, in order to continue generating cash flow. The bottom line is that whether the stock is going up or down, you can still generate the same amount of cash flow each month.

Budget and Balance Sheet

According to Warren Buffett, accounting is the language of business. You need to have the capability to compile and read your own personal financial statements. You do not need a degree in accounting, just the basic skills to develop a monthly budget and balance sheet. You need to check your totals at the end of each month and review your balance sheet: is it getting better or worse? Are you building equity or merely taking on more and more debt?

401ks

Although Robert Kiyosaki despises mutual funds and does not make 401ks a part of his financial plan, I definitely include them in my financial plan. Who is to argue with having one if your employer provides a match? Even though Kiyosaki says that is money owed to you anyway, I argue that it is icing on the cake.

In many respects you want to end up with as many tiers as possible in order to build a solid stool for financial independence. Traditionally, the old stool involved three legs:

· Social Security

· Your Savings

· Pension Plans

Pension plans are long gone folks and social security soon will be. This means that you have a one-legged stool which is probably not going to be to comfy.

I recommend the following five legged stool:

· Rental

· Covered Calls

· 401 k

· A Business

· Buffett-style stock investments

This type of stool is very sturdy and should not topple anytime soon.

Buffettology

If you are going to stay with mutual funds then as Warren Buffett recommends, you should invest in an index fund. By doing so you will avoid the high fees that come along with most traditional funds which truly eat away at your overall return.

I would also recommend that you diversify international through an international fund.

If you are going to venture outside of the world of mutual funds then you need to take an in-depth look at Buffettololgy. In that book, Mary Buffett and David Clark detail the methodology that Warren Buffett uses to identify great companies. He looks for:

· A consumer monopoly or toll bridge

· Consistent, growing earnings

· High ROE

· The ability to reinvest

· The ability to keep up with inflation

· Low debt

· Good margins

Also, if you are going to build a business you need to study up on Buffettology since it will key you in as to what makes up a good, strong business.

You can also potentially look at dividend paying stocks or REITS, royalty trusts or ETFs when you venture away from traditional mutual funds. Just keep in mind that Warren has been able to generate consistent return of over 20% over the years which he considers his cash flow. So, I would tell that if you are looking for dividend paying stocks, meld dividend yielders with Buffettology and approach it from that direction.

________________________________________________________________

The above excerpt is from my upcoming third book My Happy Assets - Taking the Last

Steps to Financial Independence.

Businessathttp://www.smallbizcoffee.com/, only $3.99. Or both are available at lulu.com. Happy Reading!