The Spending Pattern of the Poor

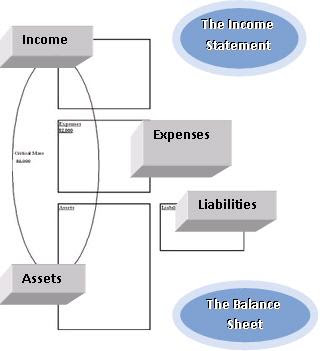

“Not to call people names by labeling them as ‘poor,’ but some people literally live paycheck to paycheck. This the spending pattern of the poor. The income comes in the door and before anything can be done with it, purchase assets or obtain liabilities, the money heads right back out the door through expenses. Examples of expenses in this category may be food, clothing, rent, toys, etcetera. Each of these spending patterns is a cycle each respective class is stuck in. Poor folks are stuck in a paycheck to paycheck spending pattern with a full expense column.

The Spending Pattern of the Middle Class

This is where most folks, the majority middle class, can be found. They buy tons of crap on credit. Jet skis, houses, electronics, cars, furniture, clothes, washer, dryers you name it. The liability column feeds the expense column. Income comes thru the door, runs smack into the expense column, bloated with liability payments, and then heads right back out the door. The liability column is stacked with toys purchased to keep up with appearances for the Joneses. The middle classes’ ability to reach financial independence is greatly diminished because 1) they focus on liabilities and 2) their income to buy assets is committed to payments for toys. This is the vicious spending cycle of the middle class. Earn, buy liabilities, spend, earn a bigger income, buy more liabilities, spend. It’s not to say that you shouldn’t have toys. You should buy all the toys you want. It’s just that you should focus on assets first. Buy cash flowing assets first and then you can have toys, freedom, control and the ability to give more.

The Spending Pattern of the Rich or, The Picture of Your Final Destination

Again, rich doesn’t mean merely having gobs of money to roll around in. Money itself is not the end, it is a means to greater enjoyment of time, choice, freedom, charitable giving, time with family, toys and hobbies. Here is the spending pattern of the rich.

The rich, rich in more ways than one, focus on assets, in particular, cash flowing assets. Instead of buying plasma TVs, they buy dividend paying stocks. Instead of buying sports cars they buy four-plexes first and use the income to buy the sports car. Instead of buying a large house, they invest in covered call option stocks which deliver a monthly cash flow stream and later buy the large house. They invest in their education on the various assets before purchasing. Rich folks invest for cash flow first and capital gains second. A rich investor will buy an apartment complex first because it makes cash flowing business sense. If the property appreciates in value, the appreciation is gravy.

_____________________________________________________________________________________

The above excerpt is from my upcoming third book My Happy Assets - Taking the Last

Steps to Financial Independence.

Businessathttp://www.smallbizcoffee.com/, only $3.99. Or both are available at lulu.com. Happy Reading!

No comments:

Post a Comment