Saturday, March 12, 2011

Friday, March 11, 2011

Three Levels of Financial Independence

And Then There’s The Riches … Now You Have It, Now What?

Really, there are three, technical levels of financial well-being along the spectrum to financial independence. Each one builds upon the other.

1. Defense and Security

First and foremost, moving closer to financial independence provides you with monetary security. If your boss comes in tomorrow and fires you, can you still afford to pay for the basic necessities; food, clothing and shelter? How long can you last before running out of money? In this book, my prescription will bring you to this stage first. Food, clothing and shelter will be taken care of. I define this stage as the ability to cover your monthly expenses via passive or portfolio cash flow. If for example, you have $3,000 a month in expenses and $3,000 in passive cash flow, then you have reached stage one. At the very least, if career or financial disaster strikes, you will be able to cover the necessities. Then and only then will you progress to stage two.

2. Having a Chair When the Music Stops

Back to my previous example, if your boss cans your ass tomorrow, it will be absolutely critical to be able to procure food, clothing and shelter. Once the essentials are covered though, you can travel further along the financial independence paradigm and build a nice chair to sit in once the music stops, or in other words, when the job ends. By nice chair I mean a source of income that provides you with excess income to buy luxuries over and above the essentials and in part, allows you indulge in a passion that you truly enjoy instead of a job unless of course you truly enjoy your job. I would define this stage as having twice the amount of monthly expenses flowing into your income column from passive and portfolio investments. If you have $3,000 a month in expenses then once you have $6,000 a month in passive cash flow, you have reached stage two.

Now, some people in the world actually enjoy the job they have right now and even if they reached this stage, they would continue to do what they do simply because they enjoy doing it and would become bored if they stopped. That is fine. Continue to work your job if you enjoy it. The point is to have options, financial independence and work that you are passionate about. Stage two is all about building a nice place to sit once the music stops and making sure you enjoy sitting there.

3. Attaining Control, Ultimate Freedom and Riches

Stage three is the ultimate goal of the financial independence paradigm. Now that the necessities are taken care of and you have a good chair to sit in after the music stops, you should now work to increase your wealth even more, give more away, spend more time with family (unless you are completely annoyed by them at this point), spend more time in service and charitable contributions, spend more time at movie theaters and ballgames, indulge in dormant hobbies such as music and art, go back to school, buy a bunch of toys and again, give more time and money away. I would define this point as generating at the least $10,000 a month in passive income and really, there is a stage four of $100,000 a month. Of course, this prescription is relative to your monthly expenses i.e., if you have $10,000 a month in expenses then truly $10,000 will be stage two for you. It can take years to get here but you hold in your hand the map to do it.

_____________________________________________________________________________

The above excerpt is from my upcoming third book My Happy Assets - Taking the Last

Steps to Financial Independence.

Businessathttp://www.smallbizcoffee.com/, only $3.99. Or both are available at lulu.com. Happy Reading!

Thursday, March 10, 2011

You Can Choose Your Own Financial Picture

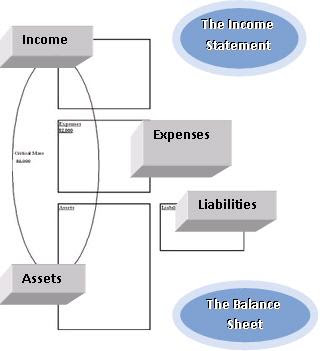

The Spending Pattern of the Poor

“Not to call people names by labeling them as ‘poor,’ but some people literally live paycheck to paycheck. This the spending pattern of the poor. The income comes in the door and before anything can be done with it, purchase assets or obtain liabilities, the money heads right back out the door through expenses. Examples of expenses in this category may be food, clothing, rent, toys, etcetera. Each of these spending patterns is a cycle each respective class is stuck in. Poor folks are stuck in a paycheck to paycheck spending pattern with a full expense column.

The Spending Pattern of the Middle Class

This is where most folks, the majority middle class, can be found. They buy tons of crap on credit. Jet skis, houses, electronics, cars, furniture, clothes, washer, dryers you name it. The liability column feeds the expense column. Income comes thru the door, runs smack into the expense column, bloated with liability payments, and then heads right back out the door. The liability column is stacked with toys purchased to keep up with appearances for the Joneses. The middle classes’ ability to reach financial independence is greatly diminished because 1) they focus on liabilities and 2) their income to buy assets is committed to payments for toys. This is the vicious spending cycle of the middle class. Earn, buy liabilities, spend, earn a bigger income, buy more liabilities, spend. It’s not to say that you shouldn’t have toys. You should buy all the toys you want. It’s just that you should focus on assets first. Buy cash flowing assets first and then you can have toys, freedom, control and the ability to give more.

The Spending Pattern of the Rich or, The Picture of Your Final Destination

Again, rich doesn’t mean merely having gobs of money to roll around in. Money itself is not the end, it is a means to greater enjoyment of time, choice, freedom, charitable giving, time with family, toys and hobbies. Here is the spending pattern of the rich.

The rich, rich in more ways than one, focus on assets, in particular, cash flowing assets. Instead of buying plasma TVs, they buy dividend paying stocks. Instead of buying sports cars they buy four-plexes first and use the income to buy the sports car. Instead of buying a large house, they invest in covered call option stocks which deliver a monthly cash flow stream and later buy the large house. They invest in their education on the various assets before purchasing. Rich folks invest for cash flow first and capital gains second. A rich investor will buy an apartment complex first because it makes cash flowing business sense. If the property appreciates in value, the appreciation is gravy.

_____________________________________________________________________________________

The above excerpt is from my upcoming third book My Happy Assets - Taking the Last

Steps to Financial Independence.

Businessathttp://www.smallbizcoffee.com/, only $3.99. Or both are available at lulu.com. Happy Reading!

Wednesday, March 2, 2011

The Four Stages of Financial Independence

Stage 1: Monthly Passive Income = Monthly Expenses

Stage 2: Monthly Passive Income = 2X Monthly Expenses

Stage 3: Monthly Passive Income = 3.33X Monthly Expenses

Stage 4: $100,000 in Monthly Passive Income

Again, using the example of an individual with $3,000 a month in expenses, the following chart shows the monthly cash flow necessary to attain the various stages.

| | Monthly Expenses | Monthly Cash Flow |

| Stage 1 | $ 3,000 | $ 3,000 |

| Stage 2 | $ 3,000 | $ 6,000 |

| Stage 3 | $ 3,000 | $ 10,000 |

| Stage 4 | $ 3,000 | $ 100,000 |